All Categories

Featured

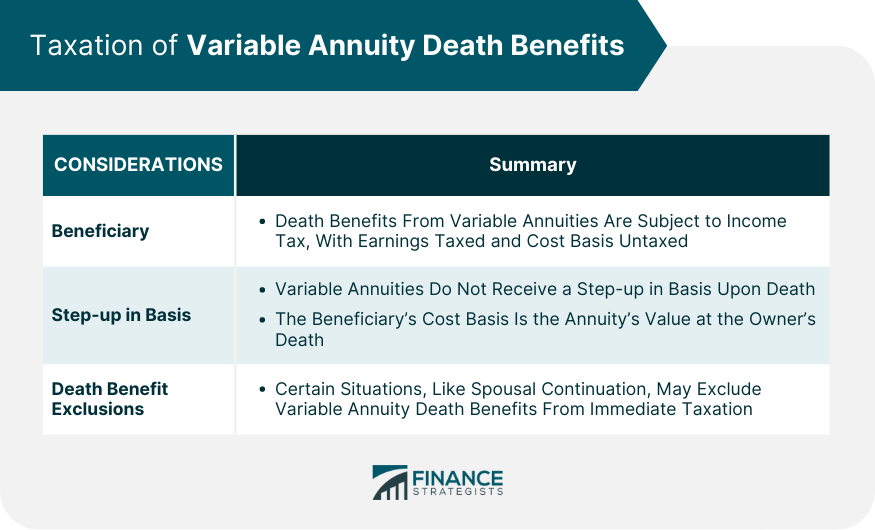

The most effective option for any kind of individual should be based on their existing scenarios, tax situation, and monetary goals. Annuity death benefits. The money from an inherited annuity can be paid as a single round figure, which ends up being taxable in the year it is obtained - Annuity contracts. The downside to this choice is that the incomes in the contract are dispersed initially, which are tired as average revenue

The tax-free principal is not paid out till after the revenues are paid out.: The recipient can request that the profits be annuitizedturning the money right into a stream of earnings for a life time or a set time period. The advantage is the payments are just partially strained on the passion part, which means you can postpone tax obligations well right into the future.:

Likewise described as the Life Span or One-year Rule, the nonqualified stretch choice uses the recipients remaining life expectancy to determine a yearly required minimum distribution. The following year, the remaining quantity of cash is split by 29, and so forth. If there are several recipients, every one can use their own life expectations to determine minimal circulations. With the stretch alternative, recipients are not limited to taking the minimal circulation (Guaranteed annuities). They can take as high as they want as much as the whole remaining funding. If you do not have a prompt need for the money from an inherited annuity, you can select to roll it right into an additional annuity you regulate. Via a 1035 exchange, you can route the life insurance company to transfer the cash from your inherited annuity right into a brand-new annuity you establish. That means, you remain to delay taxes until you access the funds, either with withdrawals or annuitization. If the inherited annuity was originally developed inside an IRA, you can exchange it for a certified annuity inside your very own individual retirement account. Inheriting an annuity can be a monetary advantage. But, without thoughtful consideration for tax obligation

ramifications, it can be a breast. While it's not possible to entirely avoid tax obligations on an acquired annuity, there are several ways to decrease present tax obligations while optimizing tax obligation deferment and boosting the long-lasting value of the annuity. You must not assume that any type of conversation or information consisted of in this blog offers as the receipt of, or as an alternative for, personalized investment advice from DWM. To the level that a viewers has any questions relating to the applicability of any kind of particular problem discussed over to his/her specific scenario, he/she is urged to talk to the professional advisor of his/her finding. Shawn Plummer, CRPC Retired Life Organizer and Insurance Policy Representative: This individual or entity is initially in line to receive the annuity survivor benefit. Naming a main recipient assists prevent the probate procedure, enabling a quicker and more straight transfer of assets.: Need to the main recipient predecease the annuity proprietor, the contingent recipient will receive the benefits.: This alternative allows beneficiaries to receive the entire remaining worth of the annuity in a single settlement. It supplies instant accessibility to funds yet may lead to a substantial tax concern.: Beneficiaries can choose to obtain the survivor benefitas continued annuity repayments. This choice can supply a steady revenue stream and may help spread out the tax obligation liability over a number of years.: Unsure which survivor benefit alternative supplies the very best economic outcome.: Stressed concerning the possible tax obligation ramifications for recipients. Our team has 15 years of experience as an insurance policy firm, annuity broker, and retirement organizer. We recognize the tension and unpredictability you feel and are dedicated to assisting you discover the best option at the cheapest prices. Screen adjustments in tax obligation laws and annuity regulations. Keep your plan current for continuous tranquility of mind.: Customized recommendations for your unique situation.: Complete review of your annuity and recipient options.: Reduce tax obligations for your beneficiaries.: Continual surveillance and updates to your plan. By not dealing with us, you risk your recipients facing significant tax obligation worries and monetary complications. You'll really feel certain and reassured, understanding your recipients are well-protected. Call us today absolutely free recommendations or a free annuity quote with enhanced survivor benefit. Get annuity survivor benefit help from a licensed financial expert. This service is. If the annuitant passes away prior to the payout period, their beneficiary will certainly obtain the amount paid into the plan or the cash worth

Annuity Rates inheritance tax rules

whichever is higher. If the annuitant dies after the annuity beginning date, the recipient will normally continue to get payments. The response to this inquiry depends upon the sort of annuity youhave. If you have a life annuity, your settlements will end when you die. If you have a specific annuity term, your repayments will certainly proceed for the specified number of years, also if you die before that period ends. It depends on your annuity and what will occur to it when you pass away. Yes, an annuity can be passed on to heirs. However, some guidelines and regulations must be followed to do so. First, you will need to call a beneficiary for your annuity. This can be done when you initially purchase the annuity or afterwards. No, annuities typically prevent probate and are not part of an estate. After you pass away, your beneficiaries have to get in touch with the annuity business to begin getting settlements. The company will certainly after that commonly send the payments within a few weeks. Your recipients will obtain a lump amount repayment if you have a postponed annuity. There is no set time frame for a recipient to declare an annuity.

Nonetheless, it is usually best to do so as quickly as possible. This will certainly ensure that the settlements are gotten without delay which any type of issues can be dealt with swiftly. Annuity beneficiaries can be disputed under specific situations, such as disagreements over the validity of the recipient classification or claims of unnecessary impact. Speak with lawyers for support

in disputed beneficiary situations (Multi-year guaranteed annuities). An annuity fatality benefit pays out a collection total up to your beneficiaries when you die. This is different from life insurance policy, which pays a death advantage based upon the stated value of your policy. With an annuity, you are basically purchasing your own life, and the survivor benefit is indicated to cover any kind of outstanding prices or financial obligations you might have. Beneficiaries obtain payments for the term defined in the annuity agreement, which can be a set period or forever. The timeframe for paying in an annuity differs, yet it frequently falls between 1 and ten years, depending on agreement terms and state laws. If a recipient is incapacitated, a guardian or a person with power of lawyer will manage and receive the annuity payments on their behalf. Joint and beneficiary annuities are the two sorts of annuities that can stay clear of probate.

Latest Posts

Decoding How Investment Plans Work Key Insights on Your Financial Future Defining Retirement Income Fixed Vs Variable Annuity Benefits of Choosing the Right Financial Plan Why Choosing the Right Finan

Highlighting the Key Features of Long-Term Investments A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans W

Exploring Tax Benefits Of Fixed Vs Variable Annuities A Comprehensive Guide to Deferred Annuity Vs Variable Annuity Breaking Down the Basics of Variable Annuity Vs Fixed Indexed Annuity Advantages and

More

Latest Posts